Report: Arizona Health-Care Enrollment Falls Short of Projections

By MAURO WHITEMAN

By MAURO WHITEMAN

Cronkite News Service

WASHINGTON – Arizona’s health-insurance marketplace reached barely half of its projected enrollment under the Affordable Care Act by the end of last year, according to an analysis released Wednesday.

The analysis by the Commonwealth Fund said the state hit just 54 percent percent of its projected enrollment in the first three months of “Obamacare,” a sluggish performance that put it in the bottom half of all states.

Of the 27 states with federally facilitated exchange marketplaces, Arizona’s year-end enrollment rate fell in the bottom 10.

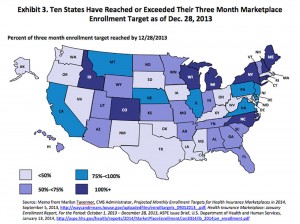

Of all states and the District of Columbia, only 10 had achieved or exceeded their projected enrollment as of Dec. 28, said Sara R. Collins, vice president of health care coverage and access for the Commonwealth Fund.

Erin Klug, health insurance exchange program manager for the Arizona Department of Insurance, said Wednesday that the ACA rollout has uncovered new problems in the state that her department will have to address as marketplace enrollment grows.

Klug, speaking during a webinar in which the Commonwealth findings were discussed, said the most prominent issue is the lack of standards covering network adequacy for preferred provider organizations in Arizona.

“We have some interesting issues coming out of the rural parts of the state,” where some PPO plans are being offered even though they may not have providers in those areas, she said.

Arizona has adequacy standards for health maintenance organizations, but only half of the “quality health plan” issuers through the online marketplace in Arizona are HMOs. The rest are PPOs.

Other problems that the state is concerned about are plan mismatches and fraud, Klug said.

The Arizona Department of Insurance has been receiving about 150 calls per month regarding the insurance marketplace, Klug said. But, by and large, the department is uninvolved in plan enrollment and eligibility, special enrollments and marketplace appeals, she said.

“After they’ve purchased insurance, that’s when the state insurance department kicks in,” Klug said.

The department oversees problems with insurance plans, claim denials and delays, claim appeals, agent misconduct, insurance scams and access to care, according to Klug’s prepared presentation.

Sarah J. Dash of the Georgetown Health Policy Institute added that states with federally run marketplaces are experiencing more coordination problems regarding Medicaid than those with state partnership exchanges or state-based exchanges.

Those states that opted for the federally facilitated exchange, such as Arizona, also had significantly less funding compared to state-run exchanges, Dash said.

Web Links:

_ Commonwealth Fund: http://www.commonwealthfund.org/

_ online marketplace: https://www.healthcare.gov/

SIDEBAR:

Lagging enrollment

Arizona’s health-insurance marketplace reached just over half of its projected enrollment by the end of last year, putting it in the bottom 10 states with federally facilitated exchanges. Those 10 and their enrollment rates:

– Arizona: 54 percent

– Indiana: 52 percent

– North Dakota: 51 percent

– Ohio: 45 percent

– Texas: 40 percent

– Louisiana: 40 percent

– Oklahoma: 38 percent

– South Dakota: 36 percent

– Alaska: 36 percent

– Mississippi: 30 percent