Report gives Arizona a grade of D for financial security of families

By Connor Radnovich

By Connor Radnovich

Cronkite News

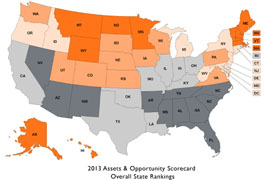

WASHINGTON – Arizona earned a D in a national report Wednesday that graded states on their families’ financial security in five broad categories.

The report by the Corporation for Enterprise Development said 45 percent of families in Arizona were “liquid-asset poor” – meaning low savings left them vulnerable to a financial shock like the loss of a job.

It was just one element in the financial asset and income measure in the report, which also looked at education, jobs, health care and home ownership. This is the sixth report, which first came out in 2002.

Being liquid-asset poor “is not a problem that is limited for just a small segment of the poorest Americans,” said Jennifer Brooks, director of state and local policy for Corporation for Enterprise Development. “This reaches into the middle class.”

In Arizona, Brooks said, 25 percent of people making between $52,000 and $87,000 in Arizona don’t have three months of savings, as the recession has forced people to dip into their bank accounts.

The average Arizonan also has $12,038 in credit card debt, $1,300 more than the national rate, according to the report.

“That has consequences not just for what can you do today to make ends meet and to save for emergencies, but also about opportunities to build long-term assets,” Brooks said.

Another factor counting against Arizona is the relatively high number of “unbanked” households, or those that do not have a savings or checking account. Arizona’s rate of 11.6 percent was the fourth-highest in the nation.

Andrea Whitsett, project manager for Arizona Indicators in the Morrison Institute for Public Policy, said many elements in the report were not surprising. But the high credit card debt and unbanked rates were both interesting, since they touched what “we would think of as higher-earning families.”

“It’s pretty scary to think that, for even some of our, quote-unquote, more-secure families, employed families, that if suddenly they have a health crisis, they have job loss, that they’re suddenly in dire straits,” Whitsett said.

Cynthia Zwick, executive director of the Arizona Community Action Association, said Wednesday’s report just reaffirmed the problems Arizona has had for several years.

“Unfortunately it’s exactly what I expected,” Zwick said. “That doesn’t mean I’m not disappointed.”

For the liquid-asset poor in Arizona, Zwick said security is essential. Not having cash available in case of an emergency can throw families into a financial tailspin.

“Even a small amount of money in savings is important for a family that doesn’t make much,” Zwick said.

She said two of the biggest problems in Arizona are education – not all kids in the state get schooling that prepares them for college – and fair full-time employment that can sustain a family.

Education was just one of the areas where Arizona did poorly: The state ranked 48th for the percentage of bachelor’s degrees among non-whites, and last for student-loan defaults.

The state’s overall worst category was in health care where it ranked 45th, dragged down by a high average employee premiums and a high percentage of uninsured low-income children – both 49th nationally. Arizona ranked 39th for the percentage of people without health insurance.

Arizona’s highest grade came for housing and homeownership, where it got a B. That grade was boosted by top-12 rankings for the number of non-white homeowners, the low percentage of high-cost mortgages, low-income homeowners and the number of one-parent homes.

In addition to measuring states’ woes, the report also calls for policy changes it says will help give families a safety net.

The report gave Arizona credit for instituting a direct-lending program last year for first-time homebuyers.

“Policy sets the rules of the game,” Brooks said. “It encourages certain behaviors like homeownership and discourages others like asset limits.”

But, she said there were still a lot of areas where the state could help, including encouraging savings and providing tax credits so people can hang on to more money.

• Financial assets and income: 43rd

• Business and jobs: 44th

• Housing and homeownership: 19th

• Health care: 45th

• Education: 36th