Arizona business leaders aim to capitalize on California tax hike

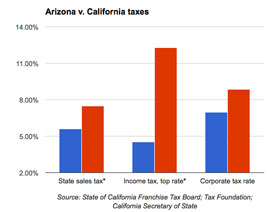

•State sales tax: Arizona: 5.6 percent, effective Jan. 1; California: 7.5 percent, effective Jan. 1.

•Corporate tax rate: Arizona: 6.968 percent; California: 8.84 percent.

•Income tax: Arizona: top rate of 4.54 percent; California: top rate of 12.3 percent, effective tax year 2012.

Sources: State of California Franchise Tax Board; Tax Foundation; California Secretary of State

PHOENIX — To Barry Broome, CEO and president of the Greater Phoenix Economic Council, Arizona has more to offer California businesses than lower taxes, starting with its cost of living.

That’s why, in the wake of a California ballot measure raising taxes, the organization plans to fly in as many as 100 California CEOs for complimentary stays and tours of the metropolitan area.

“The biggest challenge we have in our job is getting to the ultimate decision-maker,” Broome said. “I think this program has gotten us to the CEOs.”

California’s Proposition 30 will increase the state sales tax to 7.5 percent from 7.25 percent for four years as well as raise income taxes for those earning more than $250,000 for seven years.

GPEC’s program aims to lure high-tech companies and operations with 200 or more employees. So far 11 California CEOs have committed to meet with GPEC, Broome said.

“The value proposition in California is collapsing,” Broome said. “It used to be that California’s science and technology position and innovation was so profound it dwarfed any of their nearest competitors … That’s not really the case anymore.”

Arizona can offer those companies less expensive facilities for lease or sale in addition to lower taxes and cost of living. But experts say luring high-quality, high-paying technology businesses will remain a challenge.

Dennis Hoffman, professor of economics and director of the L. William Seidman Research Institute at Arizona State University’s W.P. Carey School of Business, said data suggests that technology businesses move to where the top talent is, almost regardless of regulation and taxes.

“I think GPEC’s program actually illustrates my point. They found that they’ve got to do something more innovative,” Hoffman said. “You can’t just be complacent – cut your taxes and wait for the business to show up – because it may not.”

Richard Hubbard, president and CEO of Valley Partnership, a commercial real estate advocacy group, said that the defeat of Proposition 204, which would have made permanent Arizona’s temporary 1 cent-per-dollar sales tax, adds to the attractiveness of the state’s business climate.

Phoenix has also made itself a more desirable location, Hubbard added, by streamlining the approval process for construction permits so companies can apply and begin work the same day.

“From an infrastructure standpoint, we certainly have enough vacant facilities that are move-in ready,” Hubbard said.

Joseph Vranich, president of Spectrum Locations Solutions, an Irvine, Calif.-based company that helps California companies grow and relocate, said that companies leaving California for another state can save between 20 and 40 percent.

The number of businesses leaving California this year appear to be on track with the estimated 254 companies that left in 2011, Vranich said. After Texas, Arizona is among the top destinations, he added.

“The business people I speak with out here like Arizona for a remarkably simple reason,” Vanrich said. “Phoenix is a one-hour flight from Los Angeles or Orange County.”

Not only will Californians now face higher income and sales taxes on top of already stringent regulations, a fee imposed by the state’s new cap-and-trade program, the California Global Warming Solutions Act, creates an additional burden, Vranich said.

“I call it the California economic self-destruction act,” Vanrich said. “The bottom line is, more companies are going to be motivated to find greener pastures.”